[[{“value”:”

By Wolf Richter for WOLF STREET.

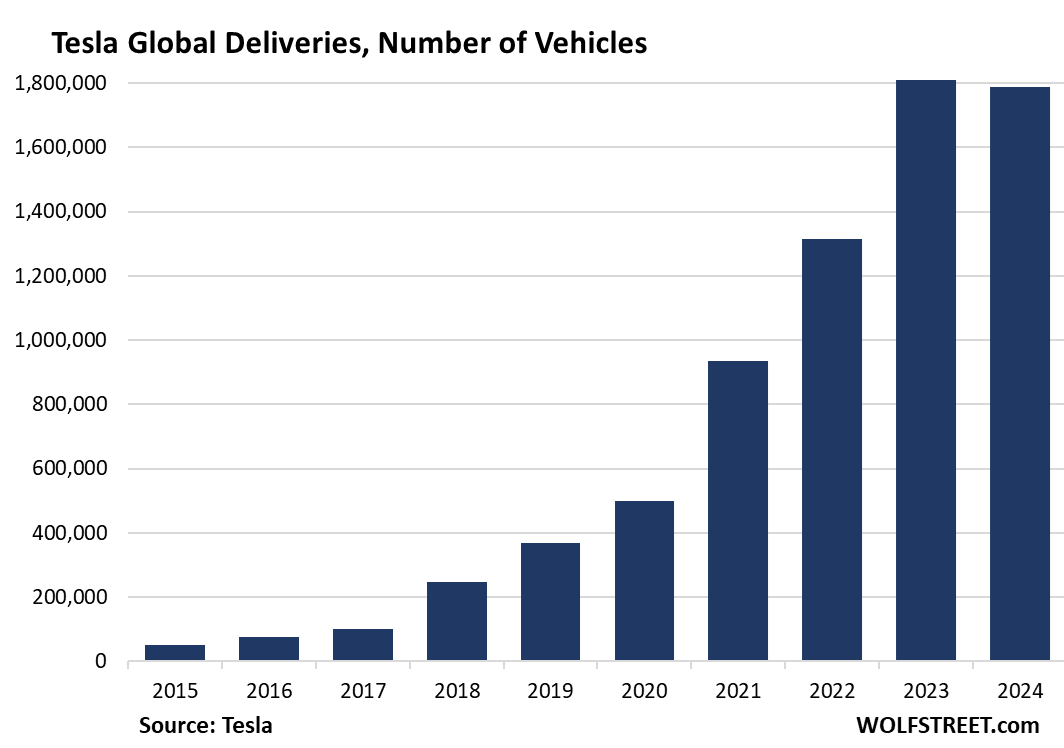

Tesla reported today that global deliveries for the whole year 2024 fell by 1.1% to 1.789 million vehicles, as is Q4 deliveries ticked up only 2.3% year-over-year to 495,570, a new record by a hair. And the growth story is over.

But Tesla’s EV competitors are making hay in the rapidly growing EV market. Tesla’s biggest EV competitor, China’s BYD, announced that deliveries of its battery-electric vehicles in 2024 jumped by 12%, to 1.764 million EVs. In Q4, it delivered 595,413 EVs, up by 13.1% year-over-year, outpacing Tesla’s Q4 deliveries by 100,000 vehicles or by 20%!

Other Chinese EV makers, whose names are familiar in the US because their shares/ADRs are traded in the US markets, announced big gains in EV sales in 2024, including:

Li Auto Inc. [LI], annual sales: +33% to 500,508 EVs; Nio [NIO], annual sales: +39% to 221,970 EVs; and Xpeng [XPEV], annual sales: +34% to 190,068 EVs.

Even US legacy automakers GM and Ford have been reporting big increases in their battery-electric EV sales in the US in 2024 through Q3 (Q4 deliveries will be announced over the next days):

- Ford EV sales in 2024 through Q3, in the US: +45% to 67,689 EVs

- GM EV sales in 2024 through Q3, in the US: +24% to 70,450 EVs

GM killed its popular Bolt and Bolt EUV in 2023 but came out with a bunch of new models that just recently have hit dealer lots. So in Q3, GM’s EV sales jumped by 60% year-over-year.

So this decline at Tesla in 2024 is a sign of trouble at Tesla – is Musk the biggest problem there now? – while overall EV sales continue to grow at a rapid pace, even as ICE vehicle sales have stalled at low levels.

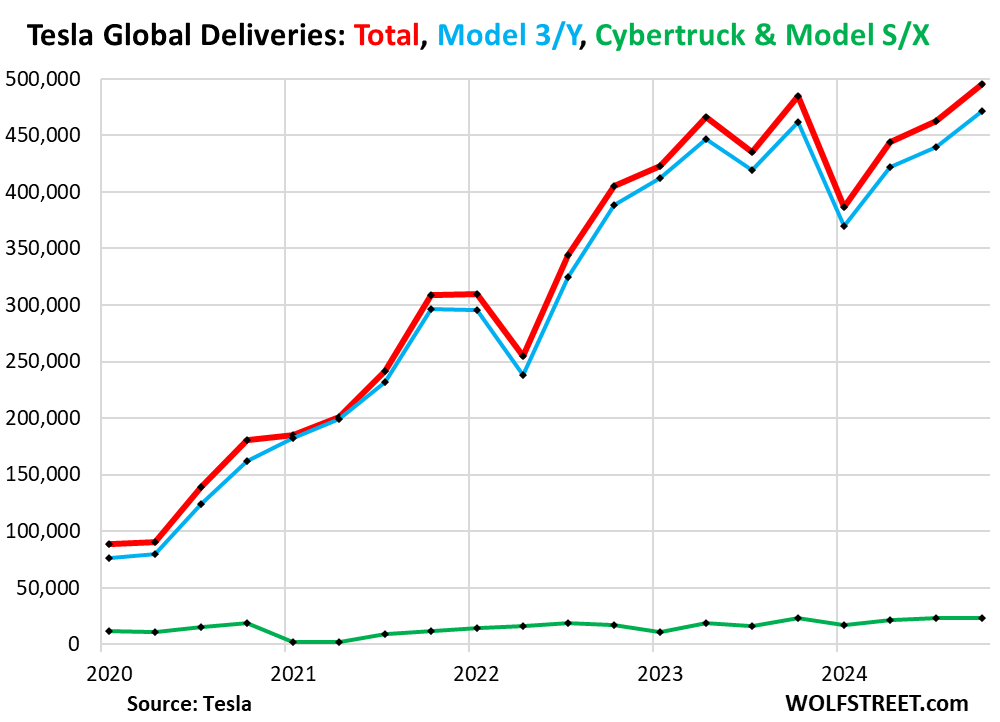

For Q4, Tesla’s deliveries eked out a record at 495,570 vehicles, just 2.3% above Q4 2023 (red in the chart below), including:

- Model Y and Model 3: 471,930 (+2.3% year-over-year, blue)

- Cybertruck, Model S, and Model X: just 23,640 (+2.9% year-over-year, green).

The Cybertruck had been the great hoopla-hope-promise, and it has been in production for a full year, but deliveries are apparently growing at a modest pace:

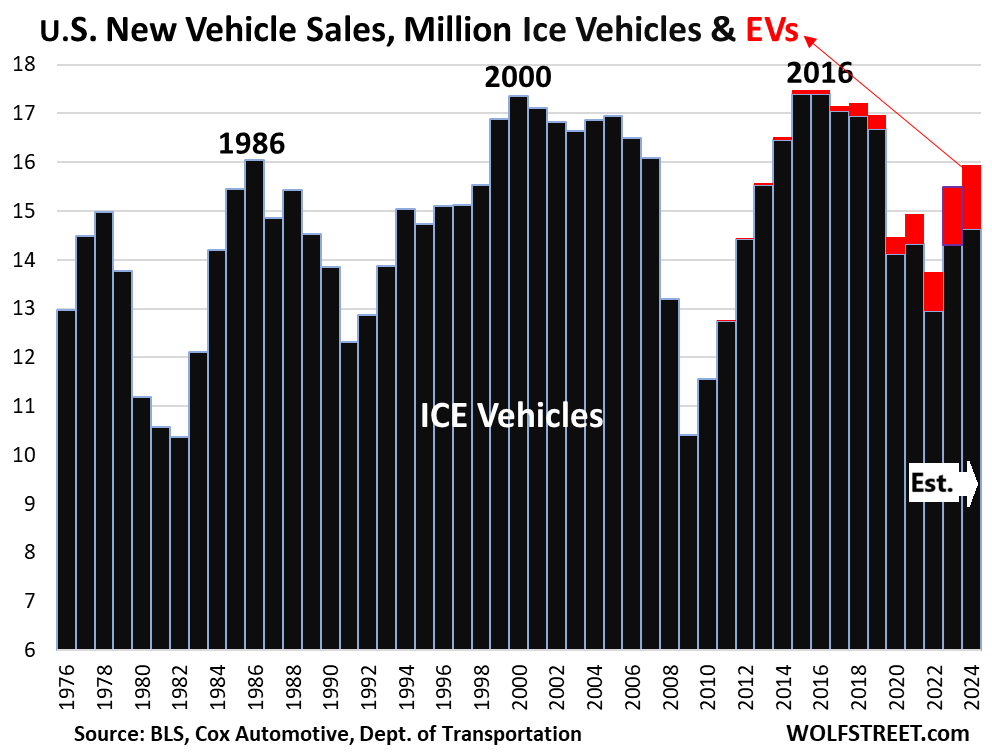

The other automakers will report their US delivery figures over the next few days. So while we wait, let’s assume that EV sales grew by only 10% in the US in 2024, dragged down by Tesla, after having grown by 46% in 2023. Then total EV sales would exceed 1.3 million (EV = red segments), while ICE vehicle sales, including hybrids, would come in at about 14.6 million (ICE = black columns). And Tesla’s role in the EV segment, while still large, is diminishing rapidly, as other EV models surge:

So how much should Tesla be worth?

With stagnating vehicle sales, losing market share, getting passed by a Chinese competitor (BYD), as other competitors catch up, Tesla is now in the same position as Ford and GM, that trade at P/E ratios between the single digits and maybe 15.

P/E ratios currently:

- Ford: 11.1

- GM: 5.5

- Stellantis: 2.7

- Honda: 7.3

- Toyota: 9.6

- Tesla: 103.2

These legacy automakers with their low P/E ratios are not good deals. They’re not undervalued. That’s where automaker stocks are – and for a good reason.

The auto industry in the US, as you can see from the chart above, has been a no-growth industry for decades, interrupted by big plunges, bankruptcies, and bailouts. Similar dynamics played out in Europe, Japan, and other developed markets.

Only rampant price increases and going forever upscale have allowed automakers to increase their dollar-revenues, even as unit sales stagnated and fell. In fact, because they kept pushing up prices of their models to increase their profit margins and dollars sales, their unit sales have fallen because their models have gotten too expensive.

Tesla is still hyping a lot of stuff that it’s going to blow your socks off with, like it used to hype the Cybertruck, the Semi, and all the other things. The biggest two hype-and-hoopla elements currently are AI and a robotaxi that doesn’t exist yet.

So OK, let’s give Tesla’s hype and hoopla the benefit of the doubt, and say that as Ford trades at a P/E ratio of 11.1, Toyota at 9.6, Honda at 7.3, and GM at 5.5, then Tesla should reasonably trade at a P/E ratio of up to 15 maybe, to be valued for reality. So divide Tesla’s current share price of $378 by about 7, to get a share price of $54, at which point it would trade with at a P/E ratio of about 15, still far higher than the major automakers in the US. It still would be relatively high for an automaker.

I’m obviously just kidding. Wall Street doesn’t care about reality or P/E ratios. Wall Street sells hype and hoopla, and Musk has long known this, and has perfectly played this game, which allowed him to fund and build the company, and its success so far. That was a huge accomplishment.

As Tesla became a profitable global automaker that now sits on $33 billion in cash. It shook up the legacy automakers, forced the entire industry to invest huge amounts in developing and manufacturing EVs and batteries for EVs, many of them in the US, which has entailed a boom in factory construction in the US, etc. etc. So this was all good and very hard to do, and Tesla managed to do it.

But now Tesla is just another mid-sized automaker with stagnating vehicle sales amid EV competitors that are eating its lunch. So it should trade like an automaker.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

The post What Should Tesla’s Stock Be Worth? Automaker, Stagnating Vehicle Sales like GM & Ford, Getting Overtaken by Competitors, Losing Share in the Booming EV Market? appeared first on Energy News Beat.

“}]]

Energy News Beat