[[{“value”:”

While examining the headlines of other publications, it is interesting to consider the potential impact of the 1-2 million barrels per day returning to the market after the sanction removal. I have a different perspective on the topic.

Subscribers to the Energy News Beat Substack or podcast have likely heard me say that OPEC+ has a limited ability to curtail production due to its access to China and India’s demand for cheap oil through the dark fleet. When the United States needs money, it just prints money at the Federal Reserve, and our corrupt Democrats and Republicans spend everything through NGOs. When Iran, Venezuela, or Russia needs additional cash flow, they drill and sell more oil and natural gas.

So, if there is an Iran Nuclear deal achieved, will we have a guarantee that we can remove their nuclear materials, and will OPEC+ be able to enforce a production cap to get the price to the $80 to 85 dollar oil that the Saudi Arabia Kingdom realisticly needs to maintain to pay for their social programs and huge building programs.

Please let me know in the comments below whether you think OPEC+ can curtail production and raise the price, or if you foresee the dark fleet and cheap oil continuing to flood the market.

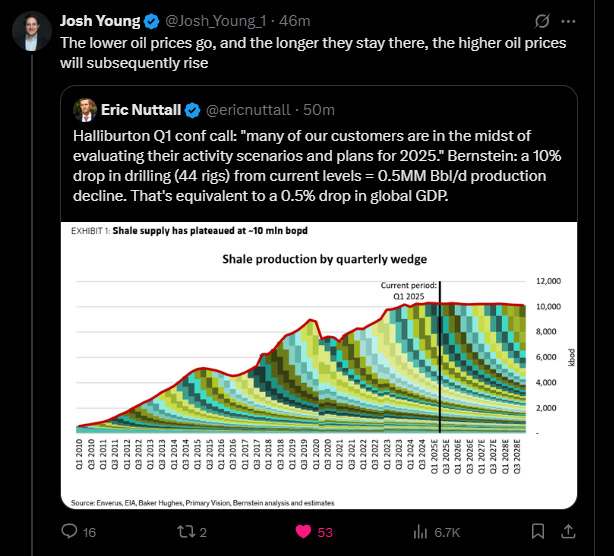

I remain a bull, and we will likely see higher prices. Industry leaders like Josh Young over at Bision Interests point out:

Josh Young – The lower oil prices go, and the longer they stay there, the higher oil prices will subsequently rise.

Key Points

- Research suggests a nuclear deal with Iran could increase global oil supply by 1-2 million barrels per day, likely lowering prices.

- It seems likely that OPEC+ might adjust production to offset this, potentially mitigating price drops.

- The evidence leans toward geopolitical tensions easing, but opposition from Israel and Saudi Arabia could complicate outcomes.

Impact on Global Oil Markets

A nuclear deal with Iran, such as reviving the JCPOA, would likely boost Iran’s oil exports, adding significant supply to global markets. This could lower oil prices, benefiting consumers but challenging other producers. However, the exact impact depends on deal terms, Iran’s production capacity, and OPEC+ responses.

Increased Supply and Price Effects

With sanctions lifted, Iran could add 1-2 million barrels per day, potentially dropping Brent crude prices to around $65 per barrel, based on past estimates. This would ease costs for oil importers like China and India.

Geopolitical and Market Dynamics

The deal might reduce Middle East tensions, but opposition from regional players could disrupt implementation. OPEC+ might cut production to stabilize prices, affecting market balance.

Risks and Uncertainties

If negotiations fail, tighter sanctions could raise prices by reducing Iranian exports. The deal’s success hinges on ongoing talks, with recent meetings in April 2025 showing progress but facing resistance from hard-liners.

Survey Note: Detailed Analysis of a Nuclear Deal with Iran’s Impact on Global Oil Markets

As of April 22, 2025, the potential for a nuclear deal with Iran, such as a revival or renegotiation of the Joint Comprehensive Plan of Action (JCPOA), remains a pivotal issue for global oil markets. This analysis synthesizes current data, historical trends, and expert projections to explore the multifaceted impacts, acknowledging the complexity and ongoing negotiations.

Background and Current Status

The JCPOA, signed in July 2015, aimed to limit Iran’s nuclear program in exchange for sanctions relief, including on oil exports. President Donald Trump’s withdrawal in 2018 reinstated sanctions, reducing Iran’s exports from 2.5 million barrels per day (bpd) in 2012 to around 1.1 million bpd by 2013. Recent developments, as reported by The New York Times, indicate progress with a first meeting on April 12, 2025, in Oman, showing pragmatism and plans for further talks. However, the JCPOA does not expire until October 2025, and a significant milestone on October 18, 2023, saw UN sanctions expire, though the E3 (UK, France, Germany) maintained their sanctions due to Iran’s non-compliance, as noted by the House of Commons Library.

Iran’s nuclear program has advanced, with its breakout time (time to produce fissile material for a nuclear weapon) now near zero, up from 12 months under the original JCPOA, according to the Arms Control Association. This escalation adds urgency, with Iran’s Supreme Leader, Ayatollah Ali Khamenei, giving negotiators one last chance, as reported by The New York Times.

Potential Increase in Iranian Oil Supply

A successful deal would lift sanctions, enabling Iran to ramp up oil production and exports. Historical data suggests Iran could add 1-2 million bpd to global markets within 6-12 months, based on CNBC estimates from 2022, which remain relevant given Iran’s current capacity of around 3.4 million bpd. Analysts like Tamas Varga from PVM Oil Associates and Reid l’Anson from Kpler project increases of 1.1-1.2 million bpd over eight months, with Bob McNally from Rapidan Energy Group noting Iran has 150-200 million barrels in storage, potentially boosting production by 900,000 bpd.

The timing, however, could take several months, as Reuters reported in 2022, with compliance verification delaying market entry until mid-2025 or later. Iran’s ability to reach 3.8-5.7 million bpd long-term depends on infrastructure upgrades, requiring significant foreign investment estimated at $100-200 billion, as per CNBC.

Impact on Oil Prices

The influx of Iranian oil would likely depress global oil prices, especially in an oversupplied market. OilPrice.com from 2022 suggested Brent could fall to $65 per barrel by H2 2023 if OPEC produces 30.5 million bpd with Iran’s return, a projection still plausible for 2025 given current prices around $70 per barrel. Reuters reported a 2% price drop on April 21, 2025, due to progress in talks, reflecting market anticipation.

Analysts like Citi Research, as per Reuters, raised forecasts in 2022 due to delayed deals, but a 2025 deal could reverse this, with potential price drops of $5-15 per barrel, depending on OPEC+ responses. OilPrice.com in 2022 noted Iran’s potential for 80% production recovery within six months, further supporting price pressure.

Geopolitical and Market Dynamics

The deal’s impact extends beyond supply. Iran’s increased exports could strain OPEC+ dynamics, with Saudi Arabia and Iraq potentially losing market share, especially in Asia. The Washington Institute from 2015 highlighted tensions with Russia, Saudi Arabia, and Qatar, a dynamic still relevant. OPEC+ might cut production to offset Iranian supply, as seen post-2018, per Reuters.

China and India, major buyers, would benefit, with China importing nearly all Iranian crude via “ghost ships” to evade sanctions, as noted by Reuters. Europe could see Iran as a gas alternative, competing with Russia and Qatar, with investment in fields like South Pars possible post-deal, per CNBC.

Geopolitically, the deal could ease Middle East tensions, reducing the risk premium on oil prices, but opposition from Israel and Saudi Arabia, as reported by The New York Times, could complicate implementation, potentially escalating conflicts like those in the Strait of Hormuz.

Economic and Investment Implications

Sanctions relief could unlock ~$120 billion in frozen reserves, stabilizing the Iranian rial and attracting investment, per CNBC. This would benefit global consumers, reducing inflation and fuel costs, especially for oil importers. Western firms like Total and Equinor might resume operations, though initial investment could be limited by low prices and Iran’s terms.

Risks and Uncertainties

The deal faces significant risks. If negotiations fail, as threatened by Trump’s “maximum pressure” campaign, per CNBC, tighter sanctions could reduce exports to near zero, driving prices higher. The JCPOA’s snapback mechanism, per Atlantic Council, allows sanctions to return if Iran violates terms, creating market uncertainty.

Regional tensions, with Israel and Saudi Arabia opposing, could disrupt oil flows, per Euronews. U.S. policy under Trump, with threats of military action, per Reuters, adds volatility, with hard-liners in both countries and Israel likely to balk, per The New York Times.

Conclusion

As of April 2025, a nuclear deal with Iran appears likely to increase global oil supply by 1-2 million barrels per day, potentially lowering prices to around $65 per barrel for Brent crude in the short term, benefiting importers but challenging OPEC+. However, the impact depends on deal specifics, Iran’s production ramp-up, and geopolitical responses. Ongoing negotiations, with recent progress, suggest a deal is possible, but risks of failure and regional opposition remain significant.

The long-term effect of the Iran Nuclear deal will depend on two key issues.

The demand side of the equation comes from China and India. India needs to grow sufficiently to meet China’s lower expectations for demand. If they can balance, the rest of the oil price modeling leans to the $80 to $85 range. At what time is a great question. Let me know your oil predictions below.

Please share your thoughts, and if you are an energy company CEO, Author, or Energy expert, I would be delighted to have you on the Energy News Beat Podcast.

Also leave your comments on the Energy News Beat Substack for oil predictions: https://theenergynewsbeat.substack.com/p/how-would-a-nuclear-deal-with-iran

Aspect

Details

Potential Oil Impact

Could add 1-2 million bpd, lowering prices to ~$65/barrel.

OPEC+ Response

Likely to cut production to offset, affecting market balance.

Geopolitical Implications

May ease tensions, but opposition from Israel, Saudi Arabia could disrupt.

Economic Benefits

Lower prices benefit importers; Iran gains ~$120B in reserves, attracts investment.

Risks

Deal failure could tighten sanctions, raise prices; snapback mechanism adds uncertainty.

This analysis integrates historical data, current negotiations, and expert projections, acknowledging the dynamic nature of global oil markets and geopolitical landscapes.

Key Citations

- Grok on X

- Oil falls over 2% on signs of progress in US-Iran talks, demand fears

- An Iran nuclear deal revival could dramatically alter oil prices

- The Art of a New Iranian Nuclear Deal in 2025

- U.S. Nuclear Talks With Iran Move Forward

- What is the status of Iran’s nuclear programme and the JCPOA?

- 2025 will be a decisive year for Iran’s nuclear program

- U.S. will collapse Iran’s economy by shutting down its oil industry, Treasury secretary says

- Trump threatens bombing if Iran does not make nuclear deal

- Do new US-Iran nuclear talks have any chance of success?

- A Nuclear Deal with Iran: The Impact on Oil and Natural Gas Trends

- Could The Iran Nuclear Deal Bring Oil Back Down?

- Iran Is “Tantalizingly Close” To A Nuclear Deal That Could Drag Oil Prices Down

- Citi raises oil price forecasts on “heavily delayed” Iran deal

- Iranian oil could take months to flow after a nuclear deal

- Oil posts weekly gain on trade deal hopes, new Iran sanctions

- Oil settles higher on fresh Iran sanctions, Iraq commitment to OPEC+

- Oil up 2% to a 2-week high as new US sanctions target Iran’s exports

- Iran nuclear talks near end as oil prices surge

- What Is the Iran Nuclear Deal?

The post How would a Nuclear Deal with Iran impact the global oil markets? appeared first on Energy News Beat.

“}]]

Energy News Beat