[[{“value”:”

By Wolf Richter for WOLF STREET.

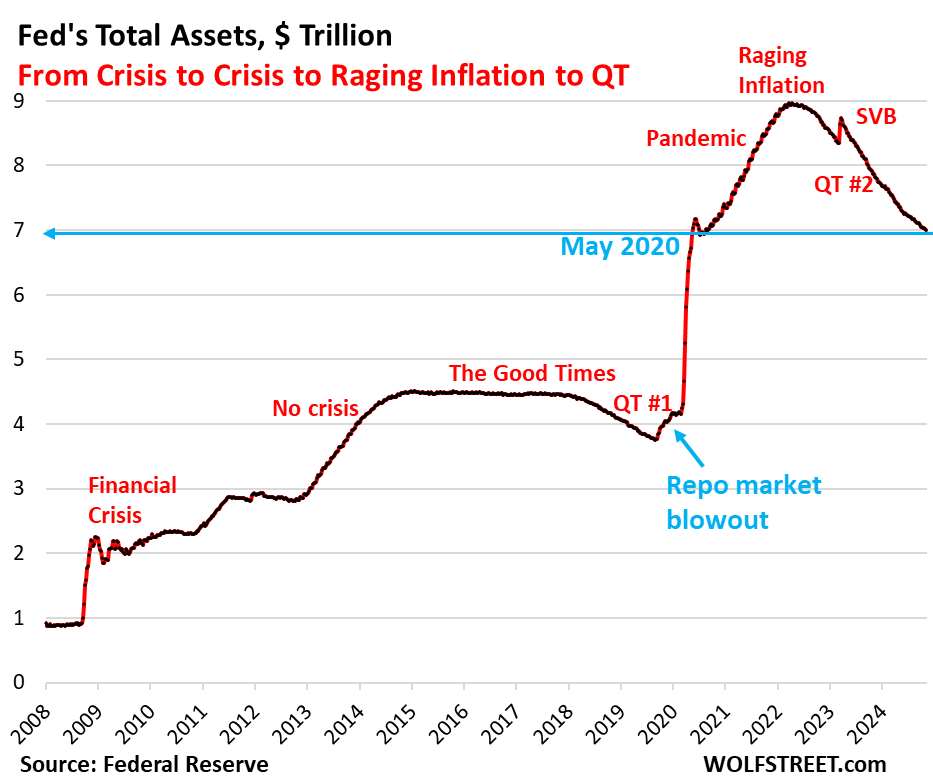

Another milestone in the Fed’s QT program: Total assets on the Fed’s balance sheet dropped to $6.99 trillion, according to the Fed’s weekly balance sheet today. The balance sheet first reached this level in May, 2020, after nearly three months of mega QE (blue arrow in the chart).

In October, total assets fell by $53 billion. Since the end of QE in April 2022, total assets have declined by $1.97 trillion, removing 41% of the assets the Fed had added during pandemic QE.

QT assets by category.

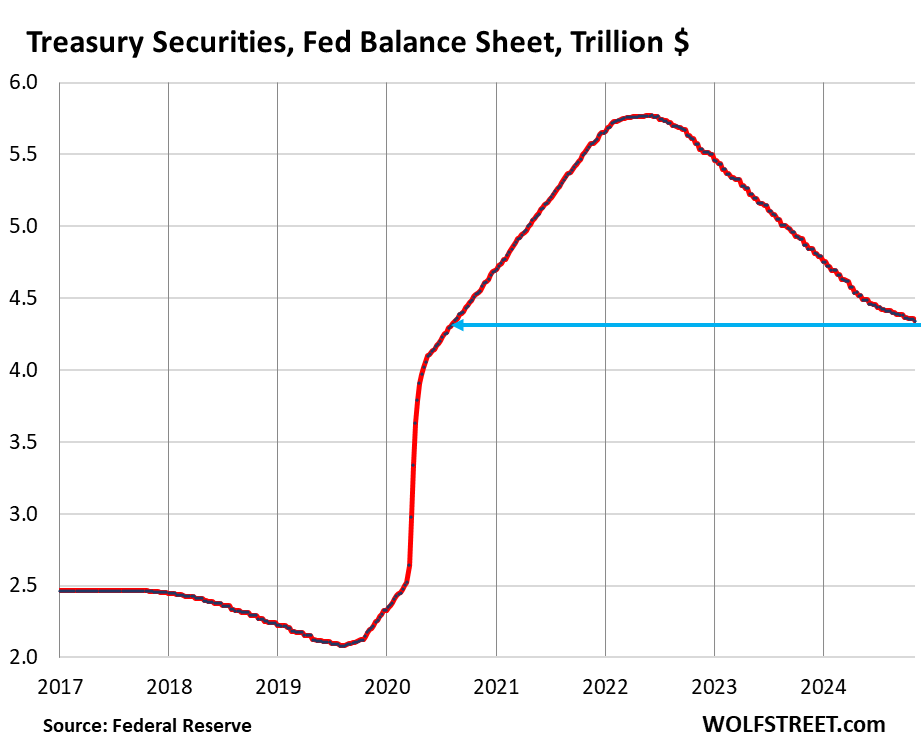

Treasury securities: -$24 billion in October, -$1.43 trillion from peak in June 2022, to $4.34 trillion, the lowest since August 2020.

The Fed has now shed 44% of the $3.27 trillion in Treasury securities that it had added during pandemic QE.

Treasury notes (2- to 10-year) and Treasury bonds (20- & 30-year) “roll off” the balance sheet mid-month and at the end of the month when they mature and the Fed gets paid face value. The roll-off is now capped at $25 billion per month. About that much rolled off in September, minus the amount of inflation protection the Fed earns on its Treasury Inflation Protected Securities (TIPS) that was added to the principal of the TIPS.

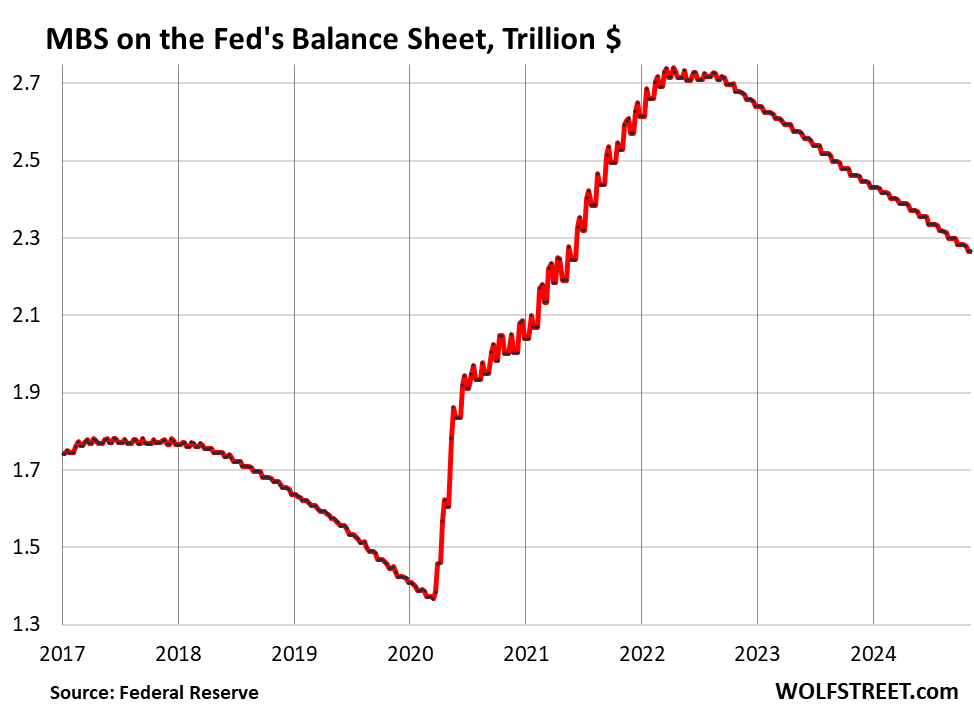

Mortgage-Backed Securities (MBS): -$16 billion in October, -$474 billion from the peak, to $2.27 trillion, the lowest since June 2021. The Fed has shed 35% of the MBS it had added during pandemic QE.

MBS come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made. But sales of existing homes have plunged, as has mortgage refinancing. So fewer mortgages got paid off, and passthrough principal payments to MBS holders, such as the Fed, have been reduced to a trickle. As a result, MBS have come off the balance sheet at a pace that has been below $20 billion in most months.

There has been some discussion recently at the Fed, including in October by Dallas Fed President Lorie Logan, about outright selling MBS to speed up the process of getting rid of them.

The Fed only holds “agency” MBS that are guaranteed by the government, and is therefore not exposed to credit risk if borrowers default on mortgages.

Bank liquidity facilities.

Only two bank liquidity facilities currently show a balance that’s above zero or near-zero: The Discount Window and the Bank Term Funding Program (BTFP). The other bank liquidity facilities are either at zero or near zero:

- Central Bank Liquidity Swaps ($151 million)

- Repos ($101 million)

- Loans to the FDIC ($0).

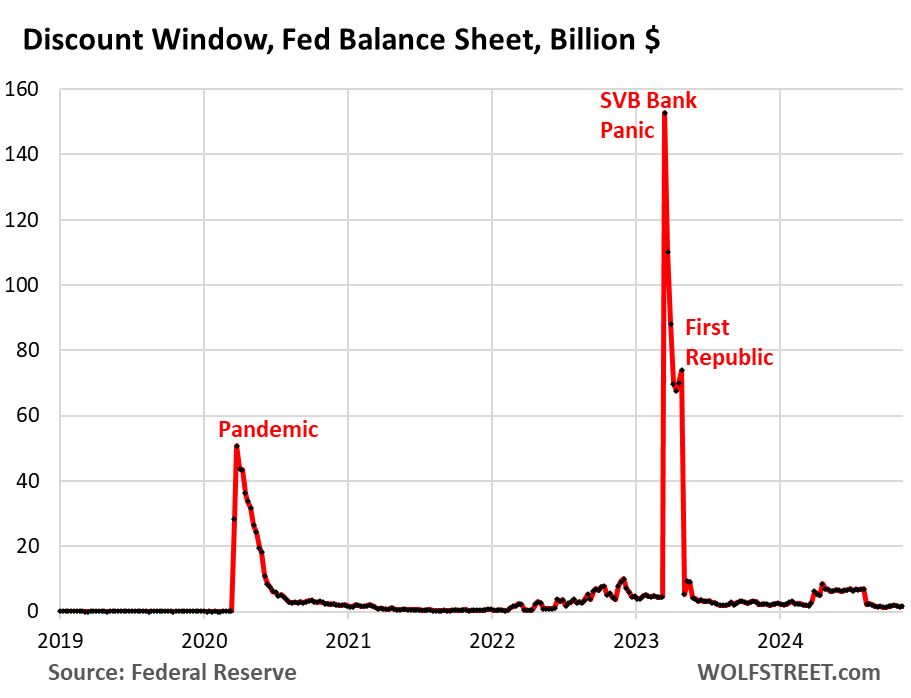

Discount Window: roughly unchanged in October, at $1.6 billion. During the bank panic in March 2023, loans had spiked to $153 billion.

The Discount Window is the Fed’s classic liquidity supply to banks. As of today’s rate cut, the Fed charges banks 4.75% in interest on these loans and demands collateral at market value, which is expensive money for banks. In addition to the cost, there’s a stigma attached to borrowing at the Discount Window.

And it’s “clunky” to use, according to Powell, who has exhorted banks to use this facility to manage their liquidity needs, and to practice using it with small-value exercise transactions, and pre-position collateral so that they can use it when they need to.

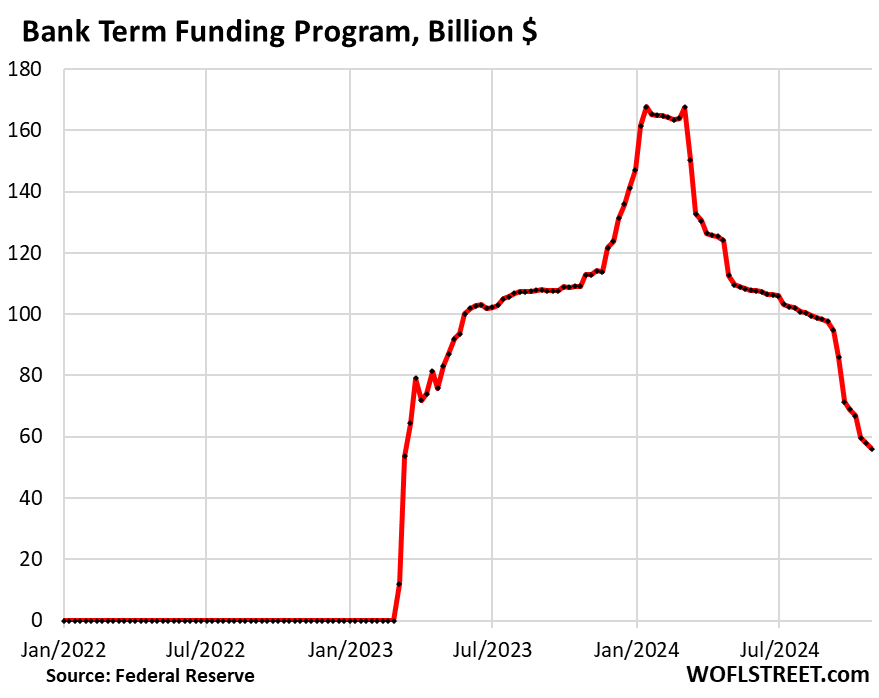

Bank Term Funding Program (BTFP): -$15 billion in October, to $56 billion, the lowest since its second week of existence in March 2023.

The BTFP had a fatal flaw when it was cobbled together over a panicky weekend in March 2023 after SVB had failed: Its rate was based on a market rate. When Rate-Cut Mania kicked off in November 2023, market rates plunged even as the Fed held its policy rates steady, including the 5.4% it paid banks on reserves. Some banks then used the BTFP for arbitrage profits, borrowing at the BTFP at a lower market rate and leaving the cash in their reserve account at the Fed to earn 5.4%. This arbitrage caused the BTFP balances to spike to $168 billion.

The Fed shut down the arbitrage in January by changing the rate. It also decided to let the BTFP expire on March 11, 2024. Loans that were taken out before that date can still be carried for a year from when they were taken out. So, no later than March 11, 2025, the BTFP will be zero, removing another $56 billion from the Fed’s balance sheet by then.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

The post Fed’s Balance Sheet Drops Below $7 Trillion. QT: -$53 Billion in Oct., -$1.97 Trillion from Peak, to $6.99 Trillion, Back to May 2020 appeared first on Energy News Beat.

“}]]

Energy News Beat