[[{“value”:”

ENB Pub Note: This is an article from the BOE report in Canada by Terry Etam. I have reached out to him to record an episode on this topic on our podcast. Terry is a great author and has excellent points about Canada and their energy policies and investments. How will Canada attract investments when their energy and regulatory policies are not going to be as friendly to businesses as the United States. He brings up some excellent points.

It seemed fitting the other day, when discussing current global events with a particularly erudite friend (and if you think that’s a ten-dollar word hold onto your hat), the word ‘haruspicy’ came into the conversation. Haruspicy is “a form of divination that inspects the entrails of sacrificed animals, particularly the liver of sheep and chickens, looking for omens.” We had exhausted all other options. The mission was unsuccessful; two buckets later we were no closer to understanding what was going on, and that was pretty much our last hope.

As online dude Trader Ferg (great Substack follow for investment thoughts) said in his weekly note, it is mentally taxing to keep up with the news flow and what matters. Everyone is used to spotting a headline and integrating it into their framework of “how the world works”. The higher up the ladder you went, geopolitically speaking, the easier that was, because, well, that’s who controls the frameworks in our societies. We have developed expectations, for better or worse, how the EU will react to something, or Russia, or China, or the US.

But now we have situations like, for example, the US’ top trade representative/negotiator not knowing what tariff levels will be later that day because the President will be deciding that number. Now, that might make sense from the highest level because Trump is playing the negotiating game that he is legendary for (for good reason), but on the ground, the question of what tariffs mean on actual products or imports has left everyone befuddled. (Some products are exempt, but no one is really clear on what…some have been treated as exempt because no one bothered to do the paperwork…or the example the Wall Street Journal gave of a piston crossing a border 7 times (Mex/Can/US) before being sold to a customer – how on earth is that to be tariffed? Or will that piston now be worth $1,000?)

These days, all the analytical inputs are so wild and unpredictable that analysis of what is going to happen feels hopeless, like garbage in, garbage out, and we know our assumptions are garbage before we even input them. People try to process three or four conflicting bits of information and the only way to integrate it into a singular thesis is if the outcome would be regarded as a lunatic’s statement on its own.

There are no simple answers anymore. Not even in the chicken guts. But thankfully, we’re here to talk about energy, and that is mercifully more clear than everything else. Well, that’s not quite true. Things go go any which way at all. But at least with energy, there are a few structures being built that we can reasonably assume will remain, and plan around them.

Ironic as it may seem, given the chaos of tariff wars, one firm element comes from the US. From Canada on the same topic, we have an ominous silence. Or worse. I’m referring to expectations of future energy policy.

In the US, the latest White House energy blast is about as crystal clear as it gets, and is going to send a shock wave through Canada of immense proportions, on the energy front, in a way that is exclusive of tariffs. If you can believe it. What is happening is that the US is dismantling, or looking to dismantle, the vast federal/cultural apparatus that sought to accelerate an energy transition. The policy prescriptions put forward are every bit as engulfing as that sounds.

Let’s walk back in time a bit to five years ago, when Greta Thunberg roamed the land, touching foreheads and curing the lame. It was a wild time for energy. It was particularly hard for energy writers; describing the energy world over the past decade has required ever more bombastic language, which is no fun to use because well who wants to be the next tabloid, but it is an undeniable fact that, compared to decades before, the most recent one has been the wildest by far. Prior cycles were defined by price shocks. Well, we had those, but we also had a new industry arise – one that wanted to obliterate the existing hydrocarbon industry that keeps everyone alive. It was surreal. Short-cycle memories cry out “Oh come on, you’re exaggerating” at that statement, but in 2019, children were indeed marching in the streets, around the world, carrying signs with slogans that they couldn’t possibly understand such as “Fossil fuels are killing the planet” or some such, at the very moment their idealistic but misled little skulls kept from freezing by the very fuels they sought to destroy. A subset of society did indeed make a very public (and well funded) objective to dismantle/defund our existing hydrocarbon energy system. These well-paid groups (e.g., Sierra Club, which calls itself a “charitable organization” and yet proclaims in their annual report such programs as “New Jersey does not need another power plant” which is a very odd charitable activity don’t you think but anyway Sierra Club has annual revenue of nearly $200 million, $84 million of which is spent on “studying and influencing public policy” which again stretches the definition of the word charity by a considerable margin.), with literally nothing else to do, embraced every sort of guerilla tactic imaginable to decimate the hydrocarbon industry, including funding endless lawsuits, public protests, lobbying governments, physically blocking new projects, etc.

They were immensely effective at swaying public opinion, at damaging the hydrocarbon-based energy sector, and at increasing energy prices (no one wanted to talk about that last one out loud, but we could all see it). They made it simple: Hey world, would you rather get your energy 100% organically from the wind and sun, or dirty old oil? And the world, that knows next to nothing about how any of these things happen, said Well of course we’ll take the clean twins. And energy ignorance took over the land. We could see those vectors in the energy world, definitely with a direction, in Canada, in the US, and in the EU. The International Energy Agency added credence, saying in 2020 that, to meet climate goals required for our survival from a climate emergency, there could be no new fossil fuel development/investment after 2021.

All that is now out the window. (This past week, the IEA said that we do indeed need new fossil fuel investment. But that’s not the half of it, and few get worked up about IEA demand projections anyway.) Us poor energy writers must reach again for the hyberbole, because the word bombastic is the most fitting one to describe the new energy program unleashed by the Environmental Protection Agency. The EPA, under new leadership (Trump appointee Lee Zeldin), is literally blowing up almost every facet of restrictive energy policy implemented over the past 10-15 years, the policies that ENGOs such as Sierra Club so carefully crafted and had implemented. Zelda recently announced “31 Historic Actions to Power the Great American Comeback”, in 31 snappy little bullets. Each is a big deal.

Alex Epstein does an excellent job of clarifying what many of Zeldin’s bullet points actually mean (here). There are too many to go through, each with significant energy policy repercussions, but a few are worth noting for their significance.

One of Zeldin’s bullets (sounds like a sci-fi book) is “Reconsideration of the 2009 Endangerment Finding”. The 2009 ruling being reconsidered declared that greenhouse gases qualified as pollutants under the Clean Air Act. This was a massive decision, not just because it made your breath illegal, but because it required that the EPA regulate these pollutants. The 2009 Endangerment Finding therefore became the biggest club you can imagine in the fist of governments and ENGOs that were salivating to use it. It became a pillar of these entities’ objective to dismantle the hydrocarbon industry. We can see how valuable it was to, for example, the aforementioned Sierra Club. From their website: “Climate advocates reacted with rage,” Sierra Club noted in a response that outlined the myriad ways in which $84 million worth of lawyers would soon be marshalling resources to neutralize Zeldin’s bullets. (A previous Sierra Club posting from Feb 2025, in reference to the looming EPA-gutting, ruefully noted: “That is the playbook. They said what they were going to do, and they’re doing it.” The Sierra Club et al don’t want to get into this much notion much, because it highlights what needs to be highlighted: This was indeed a plank upon which Trump ran, and on which he won; a popular revolt against “environmental” overreach. If you hate Trump, no one cares. This was spelled out before the election as a certainty, and it’s happening now.)

Those are US examples and a tangential reference to where the US might go from here, industrial policy wise (you can’t shout “iNVEST HERE” much louder). Attach value judgements as you wish; I can’t even begin to opine on whether, for example, “Reconsideration of Particulate Matter National Ambient Air Quality Standards” is a worthwhile pullback of governmental overreach, or something that will reintroduce smog. The truth is probably somewhere in the middle, but in today’s world, nuance is for weiners. I will let the partisans decide to love it or hate it, the emotionless fact of the matter is: It’s here, and likely to become real, and it (along with all the others) will dramatically tilt the global investment landscape.

Which brings us to Canada. We should all know by now that, as an old Canadian Liberal named Jean Chretien once wisely said, “There is nothing more nervous than a million dollars – it moves very fast, and it doesn’t speak any language.”

Canada’s productivity has been falling relative to other large industrial economies, one of the reasons being insufficient capital investment. Whether anyone likes it or not, Canada is going to have to be competitive with the US to attract capital.

There are many facets to that discussion – ‘how to attract capital’ is a fairly grand strategy statement that touches on a lot of things, and could fill a book – but for the purposes of energy that is as cheap or cheaper than the US as the industrial base, the walking back of all these EPA regulations places a large spotlight on Canada, like an interrogator’s uncomfortably close lamp, and asks the Great White North: What you gonna do about it?

The Conservatives have been running on the plank of “Axe the Tax” for some time now, in reference to the consumer carbon tax, and it was a good tactic because it sure as hell resonated with people. Eventually and bizarrely it even started to resonate with the people that implemented the tax; few saw coming the strategic gambit thrown down by the governing Liberals, to also turn on the tax that they had championed for so long, and then theatrically rip it up in a successful annihilation of a key Conservative platform. (I smell the cleverness of Gerald Butts, but whatever, it seemed to work, somehow…they really have Canadians figured out.)

These actions make sense from a political perspective, because consumers vote and businesses do not. Politics is a simple sport in that dimension.

But thinking heads need to get back to Chretien’s comment, and ask; so…you both now favour axing the consumer carbon tax, what are you going to do about the business carbon tax? And that is a very important question, the answer to which will arguably have far bigger consequences on Canada’s economy (and possibly autonomy) than the tariff brouhaha, which will almost certainly be resolved within half a year.

We know where Mark Carney stands, and where the Liberals will go. Carney has made the ‘climate emergency’ his hill to die on, and we should expect nothing less if he gets elected prime minister. His overall plan is to still go hell-bent-for-leather on climate action, but to have businesses exclusively carry the load. He is all in on the topic. Recall that he tried to orchestrate the actions of the world’s financial and insurance industries to squeeze hydrocarbons out of existence at the fastest pace possible. He didn’t just participate, he spearheaded the entire GFANZ movement. He might have recently joined the Conservatives in denouncing the consumer carbon tax, but his first policy statements indicate that Canada will do it’s part to “save the climate”, but that it will be business alone that will do the job (you don’t need to tell me what happens when costs are added to businesses, I’m well aware, just trying to keep as many voters engaged as possible, because it’s the silent majority that will decide our next election).

It does not take much imagination to see what that will do to our capital-attractiveness relative to the US, which is moving in exactly the opposite direction.

And it would be awesome to have a political alternative to point to, but we do not have one from the Conservatives. The silence is almost equally as alarming. Who knows what they will come up with before the election, but as of today, the Conservatives’ website has this to say on the subject: “Carbon Tax Carney will pause the Liberal tax for a few months to get through the election and then bring in the mother of all carbon taxes—a job-killing, inflationary tax that will drive jobs into the hands of President Trump. The Common Sense Conservative plan will axe the tax for everyone forever. We will also axe the sales tax on home building to save you $50,000 on a new home and cut income taxes so hard work pays off.”

We need to know fairly rapidly what that means. Does “axe the tax for everyone” mean businesses as well? It’s kind of odd (which is why I quoted their political sloganeering) how the Conservatives’ messaging leaps from talking about axing the tax on everyone to talking about cutting sales taxes on home building…with no mention of anything in between, no comment whatsoever on what they will do to industrial carbon pricing. It’s quite strange, actually; repealing the sales tax on home building will save Canada’s home building industry money on the order of magnitude of possibly a few hundred million dollars, or heck let’s even call it a billion. An industrial carbon tax of any stripe, applied to Canada’s energy and energy-intensive, critical industries like steel and aluminum manufacturing, will cost Canada tens of billions, and even more critically will chase away investment capital.

Canada may get creative and force pension funds to invest more in the home land, but take a wild guess at what that will lead to in the longer term – subpar returns by forcing huge funds to invest in a small Canadian market, one that is hobbled by regulation and carbon taxation, will set up future pension challenges. But hey in the world of politics that’s the next leader’s problem.

Go ahead and hate whoever you want, for whatever reason you want. It’s a free country. Sort of. At any rate you can still vote for whomever you want. Just think about this.

Canada faces some enormous challenges at present, obviously. Voters will soon have to decide if the fight against climate change is at the very top of that list. Because when the smoke clears, that will be the clear priority in one outcome, and it will not, in the other.

Regardless, the world is changing rapidly; we are not in 2019, and no matter who is elected, they won’t be in a parade with Greta Thunberg. But what they do after election is critically important. Make a point of understanding energy policy during the campaign.

Energy is the basis for everything. It is the foundation upon which successful industrial bases are built. Particularly in light of what the US is doing – deregulation, encouraging industrial investment, etc. – , Canada’s competitive future is at stake. We need investment. We need to diversify markets for our products, and we need to find ways to add value to products that the world needs, that will secure employment and tax revenue, that will take back control of whatever we can from huge and powerful trading “partners”. In the current round of issues, in the year 2025, we don’t have a strong hand. Over the longer haul, our hand is one of the strongest in the world. We have everything the world needs, including the US (bombast notwithstanding, the US very much needs what Canada has, and will for a very long time – imagine how long it would take the US to develop an aluminum industry, for example…or, what oil price would the US need to replicate Canada’s production? A whole lot higher than it has now, a state that Trump has vowed unacceptable…so we should rest easy on that front if we survive the year). We have the option of playing it as a strong hand, if we buckle down and get to work now, across the country, cooperatively, in a way that attracts global capital and does not repel it.

The chicken guts were very clear about that.

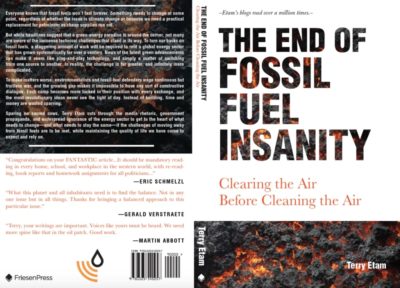

An energy transition is far more challenging than most realized, which is why we are we are where we are. Find out why in The End of Fossil Fuel Insanity – the energy story for those that don’t live in the energy world, but want to find out. And laugh. Available at Amazon.ca, Indigo.ca, or Amazon.com.

We give you energy news and help invest in energy projects too, click here to learn more

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack

The post Canada’s looming decision: US’ EPA Deregulatory Actions will force Canada’s hand – be competitive or be left behind appeared first on Energy News Beat.

“}]]

Energy News Beat