[[{“value”:”

ENB Pub Note: I will interview DRW ( David Ramsden-Wood) and David Blackmon on Wednesday about this article and Trump’s trip to the Middle East. There is a lot going on in the news cycle, and we are trying to incorporate the most correct and not-so-politically correct information. It should be a lot of fun.

It’s not #MergerMonday but it is news I’ve been advocating and waiting for for a long time: EOG just announced a 900,000-acre exploration concession in the United Arab Emirates. It’s a headline, sure. But it’s also a signal that the large U.S. E&P’s get it (and EOG in particular).

Because what’s happening now in global oil markets isn’t just about barrels. As I said in my speech in Tulsa yesterday, 6x the volume that is produced globally is traded daily. It’s a financial market, and OPEC chatter and Trump pressure have talked oil from $75 to $60 in the backdrop of declining inventories and peaking U.S. oil. The truth is it’s about strategy. It’s about alliances. It’s about who controls energy flows in a world that’s starting to fracture. And if you’ve been paying attention to Trump’s quiet moves in the Middle East this past month, you know this isn’t a coincidence. It’s a doctrine.

The Permian Is Peaking. The U.S. Needs a New Play.

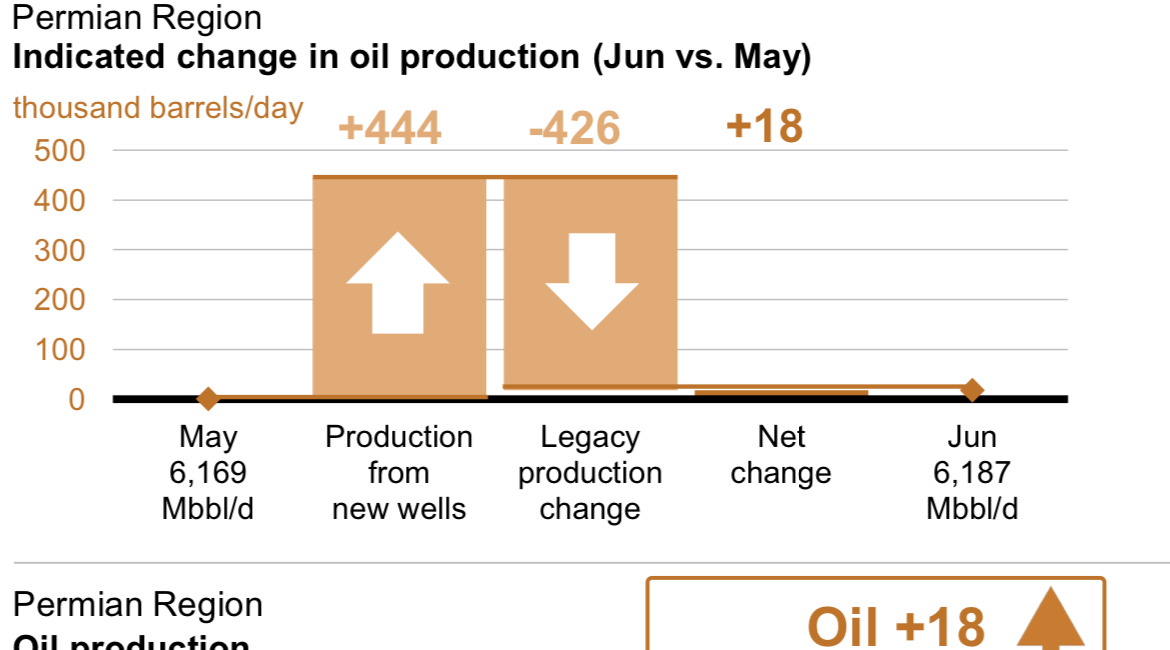

Let’s start at home. U.S. shale—specifically the Permian Basin—has been the engine of global supply growth since 2014. It’s produced 6 million barrels a day at its peak. But that engine is starting to sputter. The Tier 1 rock is mostly drilled. The wells are as long as they can be. The spacing has been maxed out. Parent-child degradation is a reality. And inventory? It’s getting thin.

EOG—arguably the best-run explorer in the game—has known this. Their Eagle Ford is mature. The Bakken is dormant. Their Permian position is good, but it’s not enough. They’ve been boxed in. The writing’s been on the wall since 2021. And today, they wrote the next chapter: go international.

Drill, baby, drill

The U.S. has been the powerhouse of global oil production, playing a pivotal role in meeting the worlds relentless demand for energy. Over the past 20 years, U.S. oil production has skyrocketed, increasing by more than 8 million barrels per day. At the heart of this growth lies the Permian Basin region so prolific that it has become synonymous with Amer…

But here’s the real story:

The Middle East Isn’t a Risk. It’s a Strategy.

Trump’s recent trip to the Middle East hasn’t made the headlines it should have as the media is too busy talking about “the plane”. So while the media chases distractions, the real play is unfolding: realigning American energy policy to the Gulf states and putting the death knoll to wind. Forget the old narrative that the U.S. wants “energy independence.” That’s not the possible anymore. The U.S. has peaked in onshore shale growth—and Biden’s domestic hostility to oil has enabled Trump to step into the void. So now? We export our expertise. We lock up acreage in the Middle East. We build deeper ties with UAE, Qatar, and Saudi Arabia—and we do it through private-sector partnerships. All the while, helping rehab MBS’s image from the Khashoggi disaster (thanks to Gavin for reminding me of that little gem).

This is not oil as commodity. This is oil as leverage.

What This Means: Oil, Order, and American Power

This isn’t just about EOG needing new rock. This is geopolitical maneuvering at its finest:

- Reduce reliance on rogue states like Iran, Iraq, and Venezuela.

- Weaken Russia without needing direct confrontation.

- Strengthen pricing power through alignment with the Gulf’s key players.

- Export American expertise and tie our energy companies to the economic future of the region.

And it’s not just about oil. It’s LNG. It’s critical minerals. It’s rare earths from Ukraine. It’s cobalt from Africa. It’s the full stack of energy and materials that powers modern economies—and the U.S. is repositioning itself as the stabilizer, and in control of the supplier.

The Quiet Doctrine: Let EOG Lead, Not the State Department

Trump’s foreign policy isn’t about speeches. It’s about control without occupation.

You don’t send the 82nd Airborne to manage Iran anymore. You send EOG to Abu Dhabi. You embed Exxon in Guyana. You lock up production with QatarEnergy and secure trade routes through mutual economic interest.

This is how you project power in a multipolar world: with drilling rigs and dividends, not destroyers.

And in a world where the BRICS bloc is trying to weaponize trade, where the dollar is under pressure, and where global supply chains are fragile as hell, having a firm grip on energy supply is not just smart. It’s necessary.

Bottom line? EOG’s UAE deal isn’t just a business win—it’s a geopolitical move that tells you everything about where we’re headed. The shale era of U.S. dominance is giving way to a global chessboard of energy influence. And if you want to know where the next battles will be fought, don’t look at OPEC quotas or rig counts. Look at EOG.

And the Biden team may have been trying to regulate fossil fuels into irrelevance—but physics is real, economics more so, and Trump is laying the groundwork to turn oil into the most powerful diplomatic tool in the American arsenal.

It’s “drill, baby, drill” energy dominance, 2.0. And it’s not domestic—it couldn’t be. So now, it hits the road.

Source:

https://substack.com/@hottakeoftheday

The post EOG Goes Abroad, and So Does American Power appeared first on Energy News Beat.

“}]]

Energy News Beat