[[{“value”:”

- Global upstream M&A activity is expected to slow down in 2025 following a peak driven by US shale consolidation.

- North America continues to lead M&A activity, while the Middle East emerges as a significant hub due to LNG expansion.

- Geopolitical tension, fiscal policy uncertainty, and the ongoing conflict in Ukraine pose challenges for the M&A market.

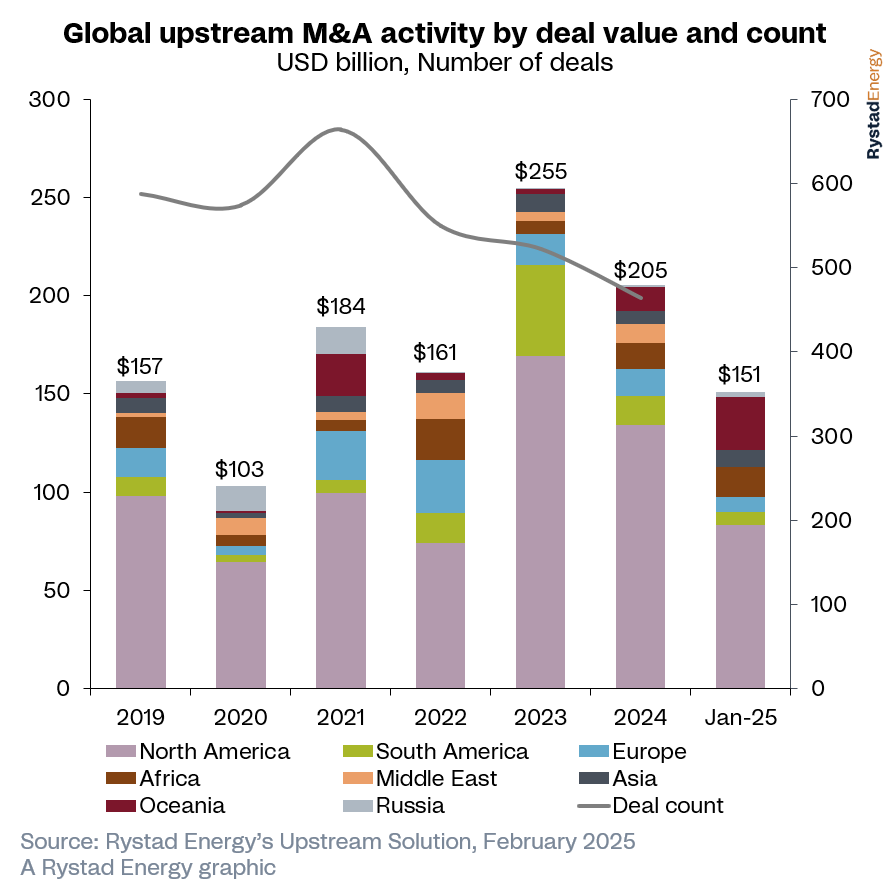

Upstream merger and acquisition (M&A) activity is expected to slow significantly in 2025 following two years of record-high transactions driven by US shale mergers. The global deal pipeline value stands at approximately $150 billion as much of the sector’s consolidation has run its course, making a return to recent peaks unlikely. Furthermore, geopolitical tension in the Middle East, the ongoing conflict in Ukraine and the UK’s challenging fiscal environment are expected to create notable headwinds for market participants.

North America will continue to lead global M&A activity, driven by nearly $80 billion in upstream opportunities on the market. Elsewhere in the Americas, South American deal value rose from $3.6 billion in 2023 to $14.1 billion in 2024 (excluding Chevron’s acquisition of Hess), largely due to regional exploration and production (E&P) growth ambitions — and despite Petrobras halting its divestment program.

Last year marked a significant year of consolidation in the US shale sector, with approximately 17 consolidation-focused deals, compared to just three acquisitions in late 2023. Activity was always expected to fall after such dramatic highs, but there is still plenty of business to be done. North America is still a leader in M&A activity and will continue to play a key role in maintaining the market’s health. There is also potential for further upside if US shale gas M&A activity increases, assuming Henry Hub prices remain stable and conducive to dealmaking.

Atul Raina, Vice President, Oil & Gas Research, Rystad Energy

Learn more with Rystad Energy’s Upstream Solution.

Looking beyond traditional hubs, the Middle East is rapidly emerging as a significant center for M&A activity. Bolstered by liquefied natural gas (LNG) expansion plans, the region recorded its second-highest year of M&A activity since 2019, with deal value reaching nearly $9.65 billion in 2024, following a five-year peak of $13.3 billion in 2022. The surge in activity can be attributed to Middle Eastern national oil companies with major projects under way, such as QatarEnergy’s North Field expansion and ADNOC’s Ruwais LNG.

The North Field expansion aims to elevate QatarEnergy’s LNG production to 142 million tonnes per annum (Mtpa) by the early 2030s. ADNOC is reportedly considering awarding an additional 5% stake in Ruwais LNG to an international partner. However, ongoing geopolitical tension in other parts of the region may dampen or delay dealmaking.

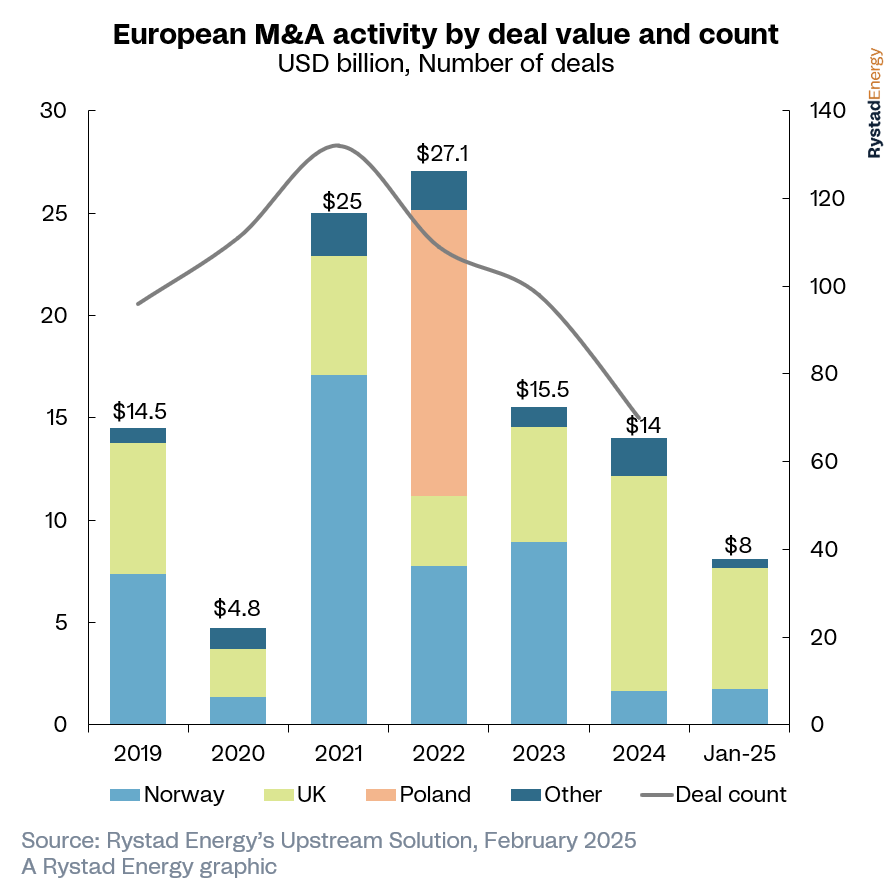

M&A deal value in Europe decreased by around 10% year-on-year, to $14 billion in 2024. Around 75% of the regional total centered on the UK, where majors have been adopting an autonomous model strategy to expand their presence in the North Sea. The largest deal this year involved Shell and Equinor merging their UK North Sea upstream portfolios, excluding some of Equinor’s cross-border assets. The combined entity will become the largest producer in the UK North Sea, with a projected output of around 140,000 barrels of oil equivalent per day (boepd) by 2025.

Despite $8 billion worth of upstream opportunities in the region, the outlook for future M&A activity in Europe remains uncertain due to fiscal policy in the UK, which accounts for 73% of the potential deals, valued at about $5.9 billion. Tightened government fiscal terms for offshore oil and gas threaten to dampen buyer interest. However, combining portfolios that balance deferred tax positions and future expenditure could be an emerging trend in the country’s M&A landscape, given the current fiscal challenges.

We give you energy news and help invest in energy projects too, click here to learn more

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack

The post $150 Billion Upstream Opportunities Remain Despite Shale M&A Slowdown appeared first on Energy News Beat.

“}]]

Energy News Beat