[[{“value”:”

ENB Pub Note: This is an excellent article from Robert Bryce’s Substack. I am reaching out to him and will try to record a podcast post on this topic next week. I highly recommend subscribing to Robert’s Substack as he is right on the mark with what is needed in the energy markets.

I have been interested in presidential politics and campaigns all my life. I cannot remember an uglier contest, or one with worse candidates, than the one that will be decided on Tuesday. As I explained in August, in “Five Reasons To Be Bullish On The United States,” I am all-day optimistic about the US. We have key advantages over the rest of the world, including world-class education, relatively good demographics, excellent geography and agriculture, cheap energy, and, more than anything, an enduring Constitution.

But we’re cursed with terrible politics and politicians.

What will happen on election day? The vote will almost certainly be close, like it was four years ago, with the outcome determined by a few thousand votes in a handful of states. Nevertheless, I hope that whoever wins, does so bigly. The last thing the US needs right now is a drawn-out process that gets decided by hanging chads.

Chads or no chads, here are my 10 predictions for this election and what we can expect when it’s over (with three charts). Want a preview? The IRA subsidies are here to stay, and the EPA’s EV mandate is dead regardless of who wins.

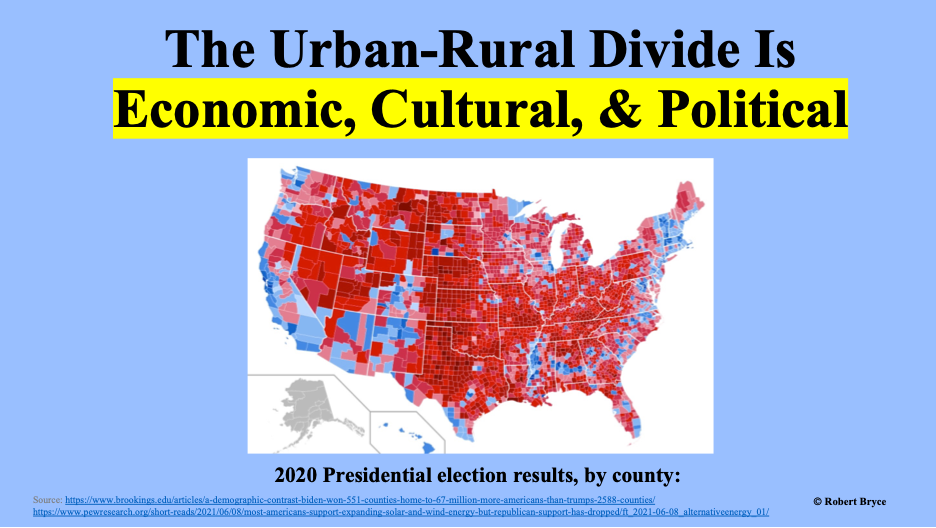

1. The vote tally will show, again, the urban-rural divide.

2. If Trump wins, he won’t repeal the alt-energy subsidies in the IRA.

The idea that the US will spend trillions on alt-energy projects while the deficit is soaring ($35.8 trillion and counting) is the definition of fiscal insanity. But Big Business is feasting on the subsidies, and the most powerful trade associations in Washington have pledged to fight to continue the handouts. Thus, there’s little reason to expect Trump will be able to eliminate the IRA subsidies even if he wants to.

In February, Dan Brouillette, who served as Trump’s secretary of energy, and is now CEO of the Edison Electric Institute, the trade association for investor-owned utilities, said EEI (annual revenue: $86.1 million) will be “very aggressive” in protecting key elements of the IRA from repeal. In May, the American Petroleum Institute and the US Chamber of Commerce said they would fight any efforts to kill the IRA’s alt-energy provisions. An official at the Chamber (annual revenue: $210 million) told Politico that the IRA is needed for “energy security, competitiveness, and the business case for the energy transition.” Meanwhile, API (annual revenue: $293 million) wants to keep the hydrogen and carbon capture tax credits.

In August, 18 House Republicans sent a letter to House Speaker Mike Johnson, saying they would oppose cuts to the energy-related measures in the IRA. They said, “Prematurely repealing energy tax credits… would undermine private investments and stop development that is already ongoing.” They continued, “A full repeal would create a worst-case scenario where we would have spent billions of taxpayer dollars and received next to nothing in return.”

The American Clean Power Association (annual revenue: $51 million), which represents the wind and solar sectors, also opposes any changes in the IRA. In May, Jason Grumet, the group’s CEO, said the chances of the IRA “being repealed or changed significantly are small.”

He’s right.

3. If Harris wins, the Anti-Industry Industry will have even more power.

4. If Trump wins, the LNG export ban will end immediately.

5. If Trump wins, the offshore wind business will be headed for Davy Jones’s Locker.

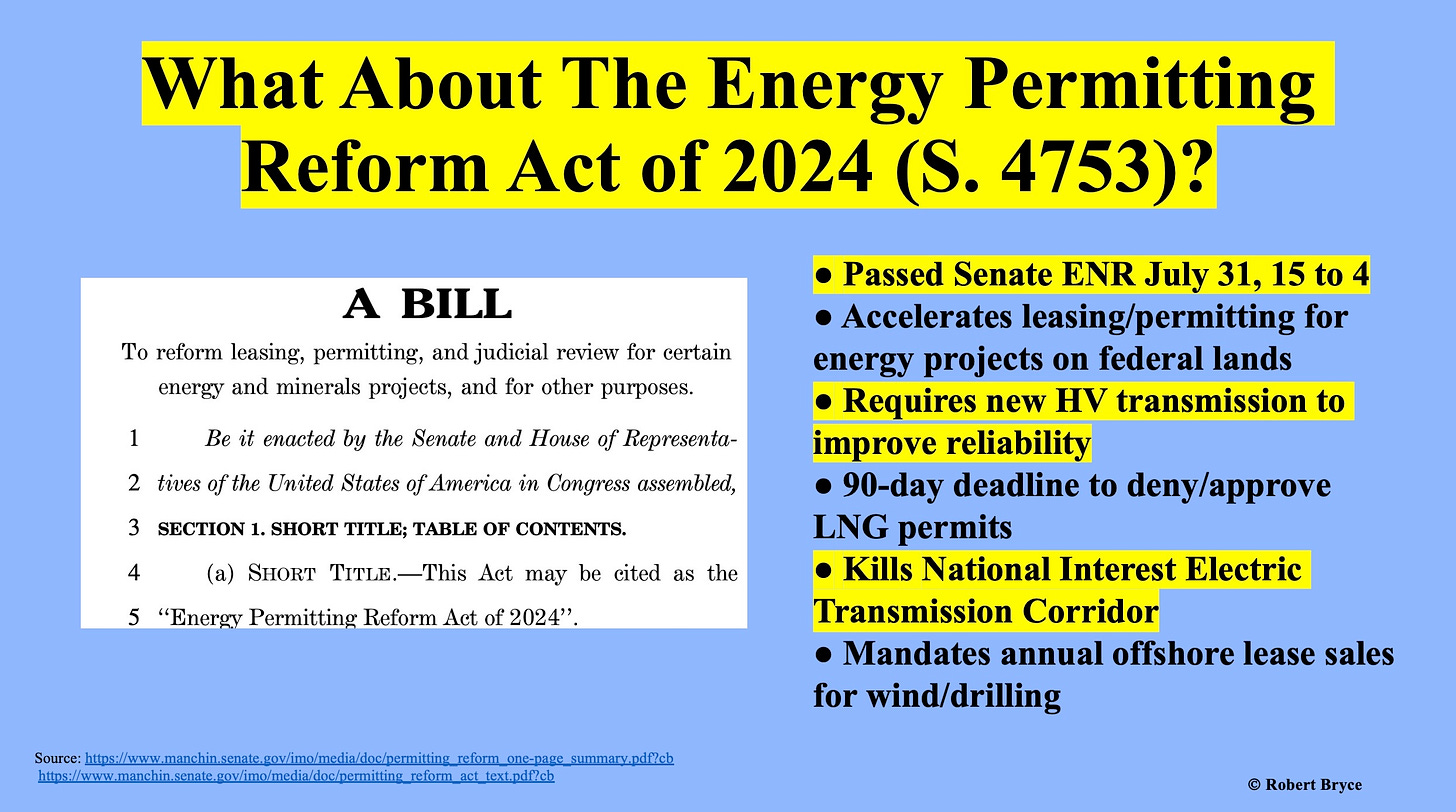

6. Regardless of who wins, permitting reform is going nowhere.

7. The EPA’s EV mandates will be scrapped.

EPA mandate on electric vehicles is a massive overreach by the administrative state. The courts will eventually overturn the mandate. That was true even before the Supreme Court issued its June decision in the Loper Bright v. Raimondo case, which ended Chevron deference. But even without Loper Bright, it’s clear that US automakers simply cannot meet the EPA’s target, or they will be bankrupted in trying to do so. Under the rule, about 70% of the new cars sold in the US by 2032 will have to be fully electric or plug-in hybrids. For comparison, those vehicles made up just 9% of new car sales last year.

The US automakers are already dialing back their EV production because consumers aren’t buying the damn things. As I noted here last week, Ford has already lost about $11 billion on its EV misadventure, including $1.2 billion in the third quarter alone. The religious belief in EVs as a climate cure is colliding head-on with the realities of the marketplace, and that will be true under Trump or Harris. One way or another, the EV mandate is doomed.

9. Regardless of who wins, the reliability of the US electric grid will keep declining.

The United States is heading for potentially catastrophic consequences in terms of the reliability of our electric power system. I am not trying to be melodramatic in using a term such as “catastrophic,” but because it is accurate to describe a rapidly growing threat of extensive and regular power outages as potentially catastrophic…The core threat is two-fold: On the power supply side, dispatchable generating resources, even with many years of useful life remaining, are retiring far too quickly and in quantities that threaten our ability to keep the lights on. The supply problem is not the addition of intermittent resources such as wind and solar, but the far too rapid subtraction of dispatchable resources, especially coal and gas. Further, the nation’s largest regional grid operators have made crystal clear that the Environmental Protection Agency power-plant regulations, which have now been finalized, will make this already dire situation much worse by forcibly accelerating the retirement of the vast majority of the remaining coal fleet and making it extremely difficult, if not virtually impossible, to build the new combined-cycle natural gas generation units that will be essential as baseload generation resources to meet the rising demand for power.

Christie’s warning is only the latest in a long series of warnings that have been made by FERC, the North American Electric Reliability Corporation, and grid operators about the grid’s declining reliability due to bad policy and the premature closure of dispatchable coal and gas plants. Furthermore, nearly all of the incentives and mandates promulgated over the past few years are encouraging the addition of more weather-dependent generation to the electric grid.

That’s the wrong way to go.

If we face more extreme weather due to climate change — hotter, colder, and more extreme for longer — the last thing we should do is make the electric grid more dependent on the weather. Unfortunately, despite the many warnings, that’s precisely what we are doing.

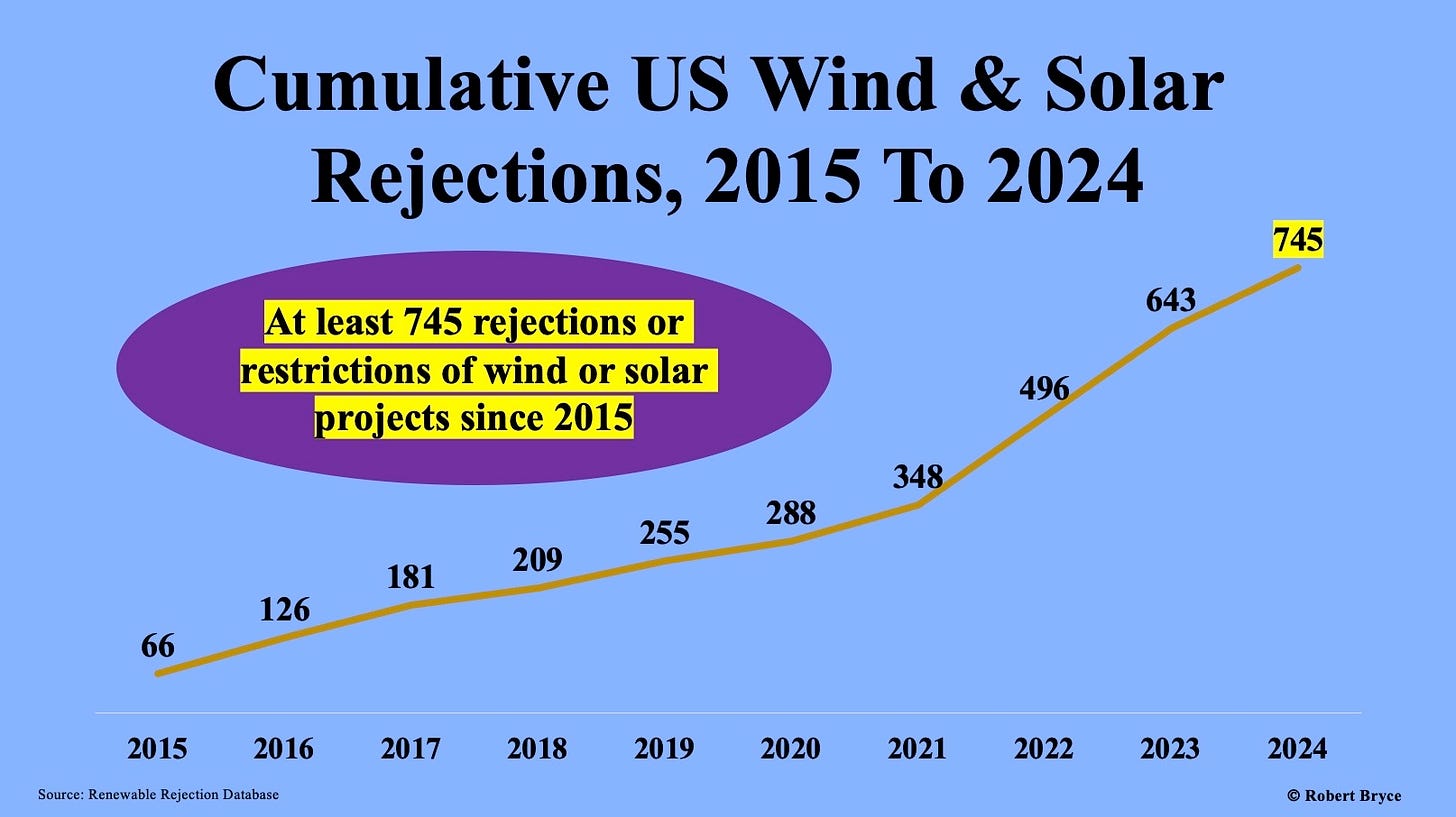

10. Regulatory uncertainty and project delays will persist in the electric sector for many years to come.

Be sure to vote, y’all. – Source: Robert Bryce, Substack

The post 10 Can’t-Miss Election Predictions appeared first on Energy News Beat.

“}]]

Energy News Beat